Loan for Purchase of Commercial Property

Loan for Purchase of Commercial Property

Empowering Your Commercial Property Investments with Tailored Loan Solutions

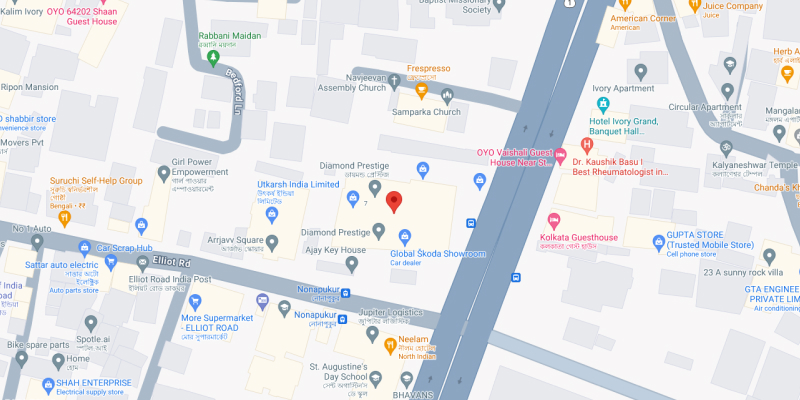

At Credential Real Estate Services Pvt Ltd., we specialize in providing financing for the purchase of Commercial Property, whether it’s an office space, retail outlet, or industrial property. Our Commercial Property Loans give you the opportunity to invest in Real Estate that can fuel your business growth. As a trusted DSA for leading Banks, we offer competitive interest rates and a fast, efficient process. With over 200 successful loans for purchase of commercial property arranged, we help you secure the financing you need to expand your commercial footprint.

What We Offer with Commercial Property Loans:

- Optimal Loan Amount

We ensure the maximum loan amount possible by negotiating higher Loan-to-Value (LTV) and Fixed Obligation to Income Ratio (FOIR) based on your property’s value.

- Customized Lender Matching

We assess your financial goals and property type to connect you with the most suitable lender for your commercial property purchase, ensuring you get the best loan terms.

- Lowest Rates in the Market

Thanks to our extensive network of lenders and a zero-delinquency portfolio, we provide you with the most competitive interest rates for your property purchase.

- Rapid Loan Approval & Disbursement

We expedite the loan approval and disbursement process, ensuring you receive the funds quickly to secure your commercial property.

About The Loan:

- This is akin to Home Loan – instead, it provides the funds necessary to buy Office Buildings, Shops, Warehouses, Factories or any other property proposed to be used for business purpose.

- Loan available to individuals, companies or partnerships looking to expand their businesses or invest in income-generating properties.

- With flexible repayment options and competitive interest rates that are fixed or floating, this type of loan allows you to make significant investments without straining your cash flows.

- Lenders assess the value and profitability of these properties before disbursing the loan, the amount in respect of which range from 50 to 70% of the value.

- Buying commercial property adds a valuable asset to your portfolio. Over time, commercial properties tend to appreciate, providing long-term returns on investment. Further, if you’re buying a property for leasing purposes, rental income can help repay the loan and even generate surplus revenue.

- If the loan is taken for business purposes, tax deductions can be claimed on the interest component under Section 37(1) of the Income Tax Act, 1961.

- Prepayment and foreclosure options are available.