-

Over two decades of Legacy

We bring over 24 years of unmatched experience in the field of Debt Advisory.

-

OVER 300 YEARS OF COLLECTIVE

PROFESSIONAL EXPERIENCE

- Our team consists of best of domain experts including Chartered Accountants, Company Secretaries, Chartered Financial Analysts and MBAs.

-

500+ Successful Projects

advised on Financial Closures

We have a proven track record of advising on and successfully closing a wide range of projects

-

6000+ Satisfied Clients

in Home & Mortgage Loans

Our dedication for customer satisfaction has earned us a loyal clientele who trust us for their financial requirements

Overview

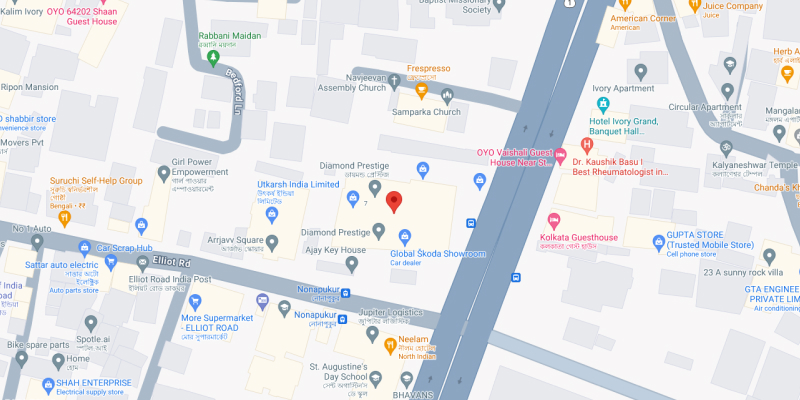

Credential Advisory Services Pvt Ltd is a leading financial consultancy company based out of Kolkata, specialising in Debt Syndication, Real Estate Project Finance, and Mortgage Loan Distribution. The company also offers expert advisory services across Private Equity Raising, Mergers & Acquisitions and Land Transactions. Expanding into asset management, its upcoming Real Estate Fund will provide Institutional Investors with strategic real estate investment opportunities, backed by a team of seasoned ex-Bankers and finance professionals.

CASE STUDIES

FEW RECENT TRANSACTIONS

- RESIDENTIAL REAL ESTATE -200 CRORE

- COMMERCIAL REAL ESTATE -120 CRORE

- LOGISTICS PARK-90 CRORE

- UNIVERSITY-80 CRORE

- WORKING CAPITAL SYNDICATION -350 CRORE

- MANUFACTURING -70 CRORE

CASE STUDIES

How can we help you?

With an extensive network of lenders and a highly experienced team, we specialise in structuring debt transactions that align with our clients’ specific requirements. Our focus is on providing simple and effective solutions, ensuring that even the most complicated financial challenges are addressed with clarity.

By choosing us, you partner with a team dedicated to your goals, leveraging deep industry knowledge and creative problem-solving capabilities. We view every challenge as an opportunity for growth, empowering you to navigate your financial landscape confidently. Let us help you transform complexity into clarity and achieve your financial objectives with ease. Your success is our mission.

ELEVATING CLIENT TRUST & BUILDING STRONG RELATIONSHIPS

Corporates who trust us

At the core of our success lies a steadfast commitment to excellence. Our experience and expertise, combined with a dedicated team, have enabled us to build lasting relationships with hundreds of clients. We pride ourselves on our client-centric approach, ensuring that each client feels valued and understood.

Our blend of experience, dedication, and client-focused strategies has not only won us the trust of many clients but has also positioned us as leaders in debt structuring solutions. We look forward to continuing this journey, helping more clients achieve their financial goals with confidence.

At the core of our success lies a steadfast commitment to excellence. Our experience and expertise, combined with a dedicated team, have enabled us to build lasting relationships with hundreds of clients. We pride ourselves on our client-centric approach, ensuring that each client feels valued and understood.

Our blend of experience, dedication, and client-focused strategies has not only won us the trust of many clients but has also positioned us as leaders in debt structuring solutions. We look forward to continuing this journey, helping more clients achieve their financial goals with confidence.

SECTORS WE SERVE

Real Estate

Polymer

Steel

Paper

LOGISTICS

Engineering

PHARMA

ORAGANICS

FABRICATION

COMPUTER PERIPHERALS

EDUCATION

HOSPITALITY

HEALTHCARE

DISTRIBUTION

Retail

Institutions We Are Associated With

To effectively serve clients and achieve financial closure, a formidable reputation and record of accomplishment with lenders, including leading banks and NBFCs, is essential. This relationship builds over decades, emphasising the importance of a solid debt portfolio. A consultant’s past performance, risk management strategies and corporate ethics are crucial factors that influence lender trust and investment decisions.

Maintaining an unblemished reputation with these institutions enhances opportunities for successful debt acquisition and management.