Lease Rental Discounting (LRD)

Maximize the Value of Your Rental Income with Our Lease Rental Discounting Services

If you own commercial, residential or industrial property with a steady rental income, our Lease Rental Discounting (LRD) service allows you to use that rental income to secure a loan. Whether you need funds for business expansion or personal investment, LRD is a great way to unlock the value of your property’s rental income. As a trusted DSA for leading Banks, we ensure that you benefit from competitive interest rates and smooth processing. With over 100 successful LRD transactions under our belt, we guarantee a quick, and hassle-free experience.

What We Offer with Lease Rental Discounting (LRD):

- Maximized Loan Potential

We negotiate higher Loan-to-Value (LTV) and Fixed Obligation to Income Ratio (FOIR), ensuring you can access the highest loan amount possible based on your rental income.

- Tailored Lender Selection

We analyze your financial profile and rental income to match you with the lender best suited to your unique situation, securing the most advantageous loan terms.

- Unbeatable Interest Rates

With our broad range of lending partners and zero-delinquency portfolio, we guarantee that you receive the lowest interest rates available.

- Quick & Efficient Loan Processing

Our streamlined process ensures fast approval and disbursement, so you can quickly access the funds you need.

About LRD:

- LRD is a loan offered against the rental income received from tenants occupying a commercial or residential property. This product allows property owners to leverage their future rental income to obtain a loan, which can be used for business expansion, working capital needs, debt consolidation, or any other financial requirement.

- LRD enables property owners to unlock the potential of their rental earnings while continuing to receiving rent and retaining ownership of the property.

- LRD is provided based on discounted (present) value of future lease rental income, generally with a margin of about 15% to 30% of the discounted value computed.

- The Lender assesses the eligible amount as above in addition to perusal of the registered Lease Deed and after ensuring the credibility of the Lessees.

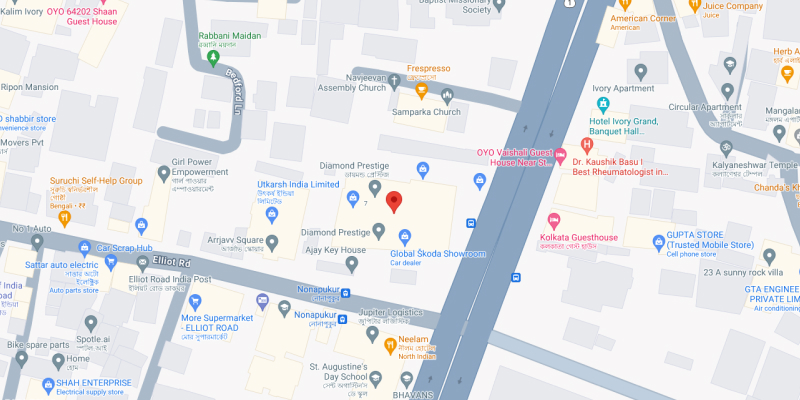

- Value of the property and its location also influence the loan approval. Properties in prime areas with high market value typically attract better loan terms.

- Both residential and commercial properties are eligible for LRD, but commercial properties like office spaces, retail outlets, and warehouses often fetch higher loan amounts.

- As the loan is secured against the rental income and the property itself, LRD generally comes with lower interest rates compared to unsecured loans.

- The tenor of the LRD loan is typically aligned with the lease term.

- Thus, LRD can convert your rental income into immediate liquidity without having to sell your property, thereby ensuring long-term wealth generation.

- If the loan is used for business purposes, the interest paid on LRD may be eligible for tax deductions under certain conditions.